CALL US TODAY · 360-734-6479

STEP 5 – TO SELLING YOUR HOME – THINKING OF SELLING YOUR HOME?

Here’s Your Homework When You Work With US

Your Name (s):______________________________ Date:_____________

Property Address:_______________________________________________________

Things we need you to do now

- Find a mortgage broker/lender if you are planning to buy another property after you sell your current property. We recommend comparing at least THREE lenders/mortgage brokers to see who will give the best terms and rates. Jump to the end of this article to find our favorite Lenders. This way, you know if you can afford to buy another property, if so if it makes sense to sell now.

- Read and sign the following documents:

- Exclusive Rights to Sell Agreement. Date this agreement for the date we are planning to put the property into MLS.

- Property Disclosures

- Return all of the above to us. We will send this to you via a separate email once we’ve decided to work together.

- Fill out the following documents (return to us once they are complete):

- Seller’s Questionnaire

- Listing Forms (see below for generic examples to get familiar with. We will send over personalized ones once we decide to work with eachother).

- Top 10 List

- Review the following documents (ask us any questions you might have while reviewing these documents):

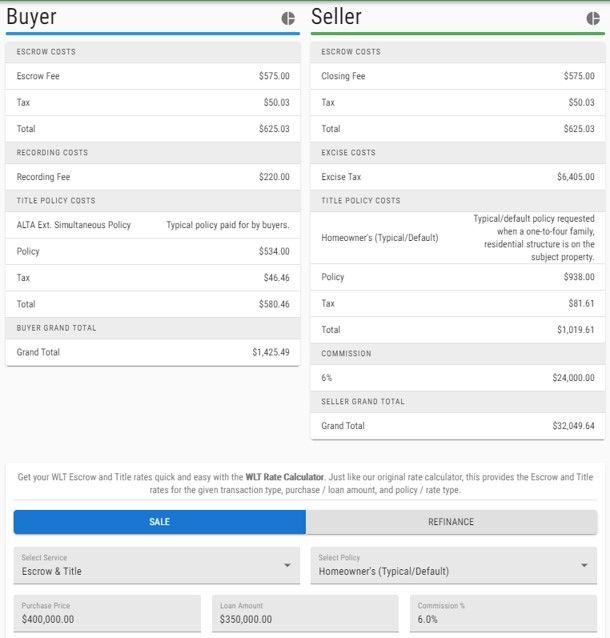

- Estimated closing costs (see below).

- Purchase & Sale Contract (see below).

- Appropriate contract riders (We will send the ones to you which you’re most likely to receive on the sale of your home)

- Change privacy settings on Facebook and LinkedIn to the highest security settings. Do not post anything about your being for sale at can be used against us during negotiations.

- Decide whether you will provide a home warranty to the buyer if they ask for one during the negotiations.

- Decide if you want Open Houses. Typically we advise doing one on the first weekend.

- Make two sets of all house keys for us.

- Have us come and so a staging evaluation. Repair, replace, etc. any items on the staging evaluation checklist before the house goes on the market

- Deep clean the house the day before it goes on the market or have someone come and clean for you (we can provide suggestions).

- Arrange for pets to be out of the home or if friendly, crated in the garage during showings.

- Hide all valuables, including money, passports, jewelry, electronics, and prescription medication. Password protect all computers

- Once the above is completed, let us know so we can order the professional photography, make the flyers and order a sign to be put out front. We can also do a Virtual Tour for an additional fee.

- Discuss with us the possibility of multiple offers, low appraisals, quick closing dates, etc.

- Download Andi’s mobile app to see the competition when you’re out and about (ask her to text it to you)

- Review the completion listings we will send to you via MLS to get to know your competition, see when you make price reductions, see what price they close for, etc. Decide whether you want to see these daily or weekly and let us know.

Once a contract has been accepted

- We will let you know when the home inspection will occur so you can vacate the property. Home inspections generally take about 2-4 hours

- We will send you a receipt showing earnest money has been received, generally within 2 business days after Mutual Acceptance.

- Start looking for a new home if you need to buy something before moving and continue the mortgage approval process.

- We will send executed contracts and inspection reports to you. If there are inspection issues our team will discuss these items with you before negotiation inspection items with the buyer’s agent.

Once the Appraisal has been cleared

- Hire movers and begin packing.

- Call and arrange for utilities to be stopped the day after closing. Phone numbers for the utility companies will be sent to you later on.

- Arrange for home owner’s insurance to stop the day after closing.

- Gather funds to cover the closing costs.

- Attend closing.

OUR FAVORITE LENDERS:

Krista Jones – Wells Fargo – 360.770.4736

Carla Lee – Advisory Lending Group – 360.631.7000

Lori Taylor – Caliber Home Loans – 360.303.2426

Hendor Rodriguez – Caliber Home Loans 360.820.1787

Amy Baker – US Bank – 360.305.6196

Bob Hoerner – Movement Mortgage – 360.558.3121

Go here to enter your numbers: https://ratecalculator.whatcomtitle.com/#rate-calculator

Questions? Contact us at andi@andidyer(dot)com or 360-734-6479.

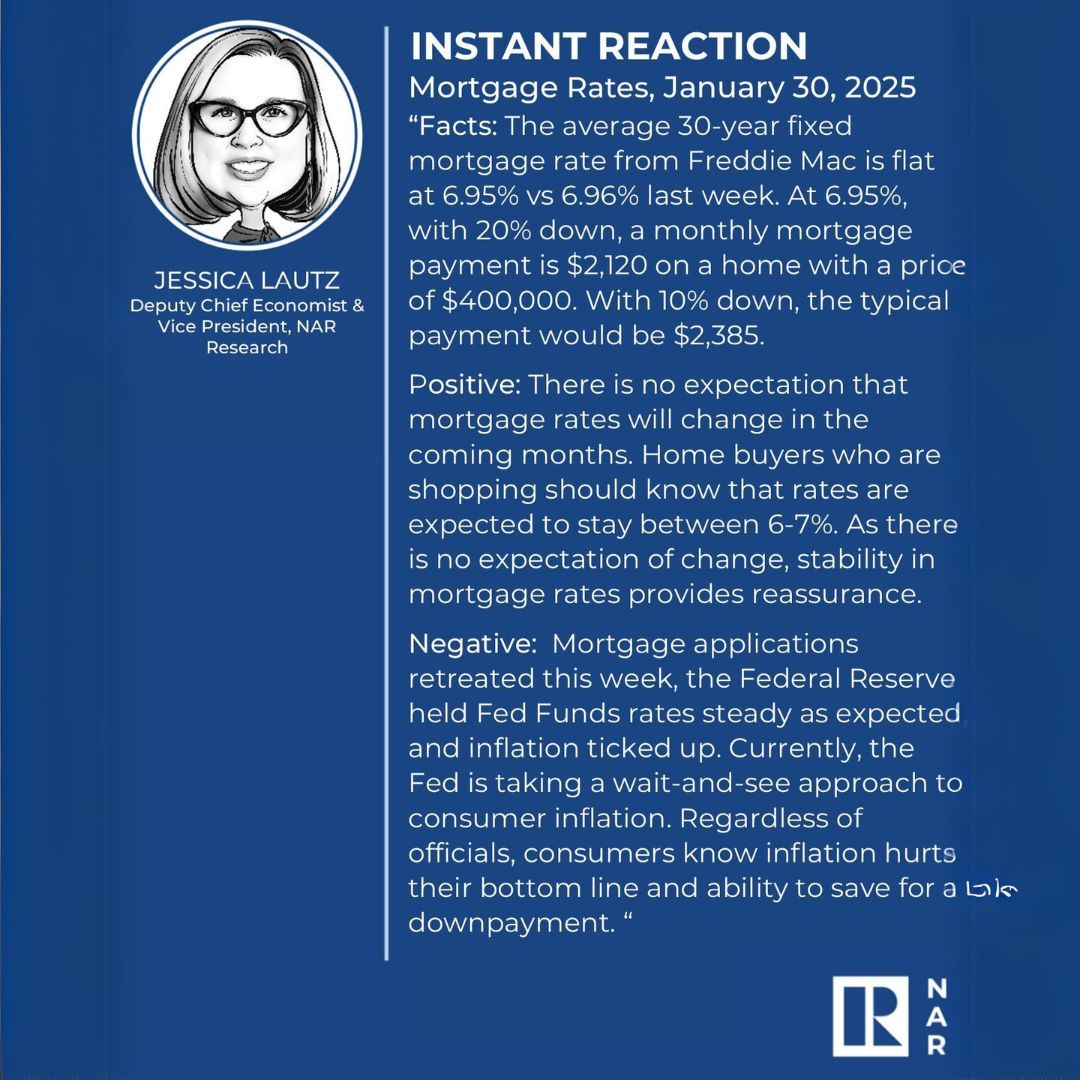

This content is not the product of the National Association of REALTORS®, and may not reflect NAR’s viewpoint or position on these topics and NAR does not verify the accuracy of the content.

Proudly serving the great people of Bellingham, Ferndale, Lynden, Blaine, and Whatcom County, WA

Office Location

Bellingham Office

RE/MAX Whatcom County, Inc.

913 Lakeway Drive