Once you’ve found a REALTOR® to represent and advise you on what is going to be the most significant financial transaction you ever make, Step 5 to buying a home is to get pre-approved by a Mortgage Lender.

Sellers want Buyers to be preapproved if they submit an offer of Purchase & Sale.

Also, it’s essential that you have an understanding of how much you can comfortably afford to spend on a home, what your monthly payments will be, what interest rate you qualify for, and how much you’ll be paying each month in taxes, insurance, etc. We highly recommend all Buyers talk to their Lender in depth before applying for a mortgage.

Having a good Mortgage Lender is a crucial part of ensuring a smooth transaction. Working with a bad Mortgage Lender can make the process a living hell for everyone involved and put your purchase in jeopardy of not closing on time or at all. You also might end up regretting the Lender you chose for years if you end up paying a higher interest rate than you should have if you had shopped your loan through various Lenders. You could also lose out on your dream property because your Mortgage Lender was disorganized and couldn’t get you fully approved during underwriting, etc. That’s why it’s important to work with the best.

Contact us for an updated list of recommended Lenders at:

andi@andidyer(dot)com OR info@sterlingrealestate(dot)com

Paperwork You Need To Gather

Each Lender has slightly different requirements regarding what documentation they need from you for the preapproval process, but in general, expect to provide the following items:

- A completed application. The Lender will provide this to you directly.

- The two most recent months (or a quarterly statement) of any asset information listed on the application. Generally: checking, savings, 401k, mutual funds, individual stock accounts, IRAs, etc.

- The most recent month of a paystub

- Past two years’ worth of US Federal Tax Returns

- Past two year’s Corporate Tax Returns (if self-employed and you own over 25% of the company)

Getting a Pre-Approval Letter

Generally, once you submit the above items to your Lender, you should receive a pre-approval letter within 2-3 business days. The Lender may ask for additional documentation. They are not trying to be difficult by asking for additional documentation; rather, after the housing bubble burst, Underwriters became much stricter regarding the loan approval process, so a lot more documentation is needed today. In addition to receiving a pre-approval letter that shows the amount you can afford to purchase, you should ask your Lender to show you what that preapproval amounts into terms of a monthly mortgage payment plus any Private Mortgage Insurance, taxes, and insurance. That way, you can make sure you are comfortable with what your monthly housing payment will be at that pre-approval letter. Once you’ve received your pre-approval letter, forward it to us for your file so we can have it when we are ready to submit an offer.

Get a Loan Estimate and Understand Your Closing Costs

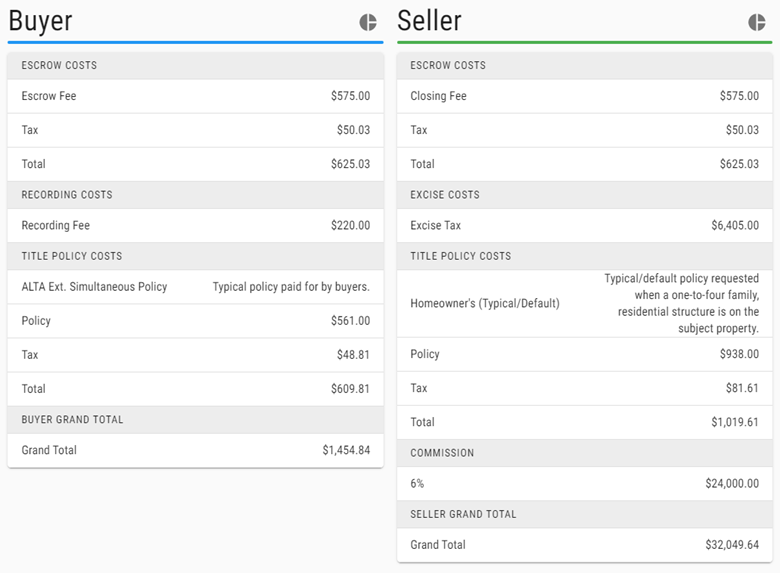

In addition, Mortgage Lenders are required to provide you with a Loan Estimate (LE) within 3 days of receiving your pre-approval. The LE provides an estimate of the closing costs you’ll need on top of your down payment and shows exactly what fees the Mortgage Lender is charging you. Make sure you understand these fees. Generally, we estimate closing costs to be approximately 2.5% of the purchase price of the property. Use the rate calculator on your Title Company’s website (or Whatcom Land Title or Chicago Title’s websites). Your Mortgage Lender can provide you with more detailed estimates based on your exact pre-approval price. Remember, these closing costs are due at closing (except for the appraisal and inspection fees, which are due on the day those services occur) and are on top of your down payment. Therefore, if you’re buying an $800,000 property and putting down 20% towards the loan, you’ll need to have $180,000 cash available at closing ($160,000 for your down payment and approximately $20,000 for the closing costs).

Should You Shop Your Loan Around?

Absolutely. Every Lender charges different fees and different interest rates, so it’s crucial you shop your loan around to at least three Lenders, in my opinion.

Ask me for a list of recommended Lenders.

Questions? Contact us at andi@andidyer(dot)com or 360-734-6479.

This content is not the product of the National Association of REALTORS®, and may not reflect NAR’s viewpoint or position on these topics and NAR does not verify the accuracy of the content.

Copyright © 2024 Andi Dyer and Sterling Real Estate Group. All rights reserved.

Leave a Reply