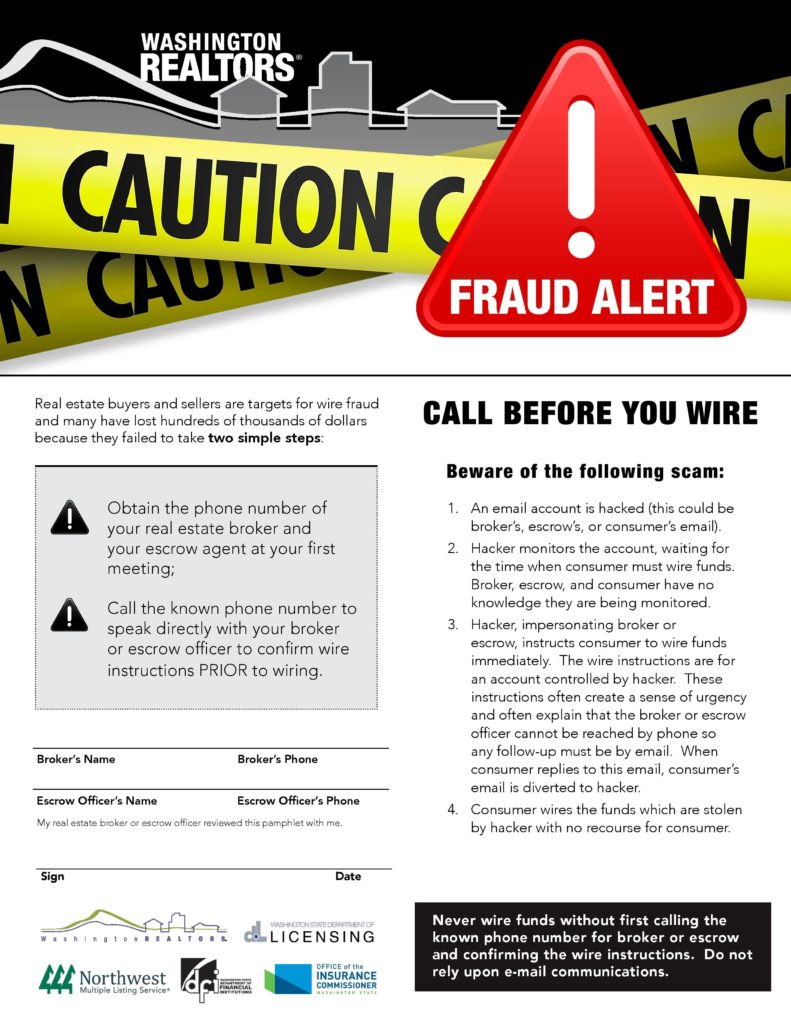

Unfortunately, one of the not-fun parts of buying or selling real estate is that you become a target for cybercrime, phishing schemes, and wire fraud. Hackers target home buyers and sellers by attempting to hack, not only your email account. They try hacking any institution involved in any transaction (us, your attorney, your lender, the Title Company, etc.). Doing so allows them to send fraudulently – yet incredibly legitimate-looking emails to you with false wire transfer instructions and even real phone numbers that will confirm instructions if called. The threat is real. Billions have been lost, and recently Whatcom County residents have lost money because they didn’t independently verify that an email they got was real and followed the wire instructions in the email. I do not want that to happen to you.

For more information on cybercrime as a whole, here’s 2 IMPORTANT VIDEOS with tips to prevent it:

Once you go under contract, be on guard for out of the ordinary communications from then until closing. Ask your attorney if they are aware of cybercrime issues if their email has ever been used in a client attack and ask what their closing procedure communications are and how you should expect to receive the wire transfer instructions and when. Know that I will NEVER send you any wire transfer instructions.

Carefully read any closing instructions and title company information once you receive wire transfer instructions. False email addresses, company phone numbers, and contact information can have subtle differences between their real counterparts, so use Google to confirm them before inquiring.

Do NOT wire transfer your funds more than 1 day before closing! Hacker tactics range from telling you to “wire money immediately” and “not to call your agent or attorney because they are busy.” In the event of wire fraud, it’s nearly impossible to get funds back after 24 hours which, is why the hackers create a sense of urgency in their emails.

Hackers have recently started asking for confirmation of personal identifiable information through spoofed emails for identity theft purposes. From here until closing, think twice before sending W2’s, social security number, bank account statements, or other personally identifiable information through email. Likely the only person who will need these items is your lender, so talk to your lender ahead of time about dropping these items off in person or uploading them to a secure portal. I will NEVER ask for personal information such as a W2, social security number, copy of your driver’s license, etc. nor will I ever ask you for any money.

If you feel as if you’ve mistakenly wired money, call someone on your closing team immediately and report it to the FBI here: ic3.gov/default.aspx.

It’s best if you can avoid wire transferring money if at all possible. Therefore, once you go under contract for earnest money payments, we recommend dropping off a personal check as it’s the most secure option available. For the closing day, instead of wire transferring money, you can bring a cashier’s check IF the amount you owe for the down payment and closing costs is LESS than $50,000. If it’s more than $50,000, then legally, your only option is to wire transfer the funds.

We have put a lot of systems in place to safeguard our email system and your data. There are also things you can do to make it harder for a criminal to hack your email. Never use free public Wi-Fi such as at the airport, your favorite coffee shop, etc. Instead use your cell phone as a portable hot spot or buy your own hot spot to use when out and about (we have and love our Verizon hot spot). In addition, don’t click on links in any emails and don’t click on that “What’s your favorite type of puppy” survey online as those are often the way hackers get into your system.

We are here to make sure you get to your closing and into your new home safely and securely, so feel free to reach out to us at any time with questions. We are never too busy to talk with you.

Questions? Contact us at andi@andidyer(dot)com or 360-734-6479. This content is not the product of the National Association of REALTORS®, and may not reflect NAR’s viewpoint or position on these topics and NAR does not verify the accuracy of the content.

Leave a Reply