Buying Step 5-6: Preparing Your Financial Foundations

Step 5

Once you’ve found a REALTOR® to represent and advise you on what is going to be the most significant financial transaction you ever make, Step 5 to buying a home is to get pre-approved by a Mortgage Lender.

Sellers want Buyers to be preapproved if they submit an offer of Purchase & Sale.

Also, it’s essential that you have an understanding of how much you can comfortably afford to spend on a home, what your monthly payments will be, what interest rate you qualify for, and how much you’ll be paying each month in taxes, insurance, etc. We highly recommend all Buyers talk to their Lender in depth before applying for a mortgage.

Having a good Mortgage Lender is a crucial part of ensuring a smooth transaction. Working with a bad Mortgage Lender can make the process a living hell for everyone involved and put your purchase in jeopardy of not closing on time or at all. You also might end up regretting the Lender you chose for years if you end up paying a higher interest rate than you should have if you had shopped your loan through various Lenders. You could also lose out on your dream property because your Mortgage Lender was disorganized and couldn’t get you fully approved during underwriting, etc. That’s why it’s important to work with the best.

Contact us for an updated list of recommended Lenders at: andi@andidyer(dot)com

Paperwork You Need To Gather

Each Lender has slightly different requirements regarding what documentation they need from you for the preapproval process, but in general, expect to provide the following items:

- A completed application. The Lender will provide this to you directly.

- The two most recent months (or a quarterly statement) of any asset information listed on the application. Generally: checking, savings, 401k, mutual funds, individual stock accounts, IRAs, etc.

- The most recent month of a paystub

- Past two years’ worth of US Federal Tax Returns

- Past two year’s Corporate Tax Returns (if self-employed and you own over 25% of the company)

Getting a Pre-Approval Letter

Generally, once you submit the above items to your Lender, you should receive a pre-approval letter within 2-3 business days. The Lender may ask for additional documentation. They are not trying to be difficult by asking for additional documentation; rather, after the housing bubble burst, Underwriters became much stricter regarding the loan approval process, so a lot more documentation is needed today. In addition to receiving a pre-approval letter that shows the amount you can afford to purchase, you should ask your Lender to show you what that preapproval amounts into terms of a monthly mortgage payment plus any Private Mortgage Insurance, taxes, and insurance. That way, you can make sure you are comfortable with what your monthly housing payment will be at that pre-approval letter. Once you’ve received your pre-approval letter, forward it to us for your file so we can have it when we are ready to submit an offer.

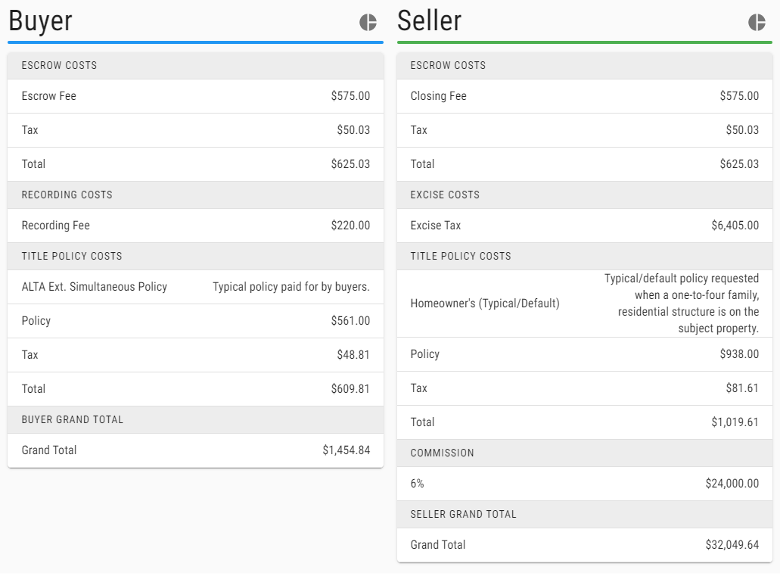

Get a Loan Estimate and Understand Your Closing Costs

In addition, Mortgage Lenders are required to provide you with a Loan Estimate (LE) within 3 days of receiving your pre-approval. The LE provides an estimate of the closing costs you’ll need on top of your down payment and shows exactly what fees the Mortgage Lender is charging you. Make sure you understand these fees. Generally, we estimate closing costs to be approximately 2.5% of the purchase price of the property. Use the rate calculator on your Title Company’s website (or Whatcom Land Title or Chicago Title’s websites). Your Mortgage Lender can provide you with more detailed estimates based on your exact pre-approval price. Remember, these closing costs are due at closing (except for the appraisal and inspection fees, which are due on the day those services occur) and are on top of your down payment. Therefore, if you’re buying an $800,000 property and putting down 20% towards the loan, you’ll need to have $180,000 cash available at closing ($160,000 for your down payment and approximately $20,000 for the closing costs).

Should You Shop Your Loan Around?

Absolutely. Every Lender charges different fees and different interest rates, so it’s crucial you shop your loan around to at least three Lenders, in my opinion.

Ask me for a list of recommended Lenders.

Questions? Contact us at andi@andidyer(dot)com or 360-734-6479.

Step 6

Your Name (s): ______________________________ Date: _______

Address: __________________________________

Email: __________________________________Phone:_________

This We Need You To Do Now

- Find a Mortgage Broker/Lender. We recommend comparing at least three Lenders/Mortgage Brokers to see who will give you the best terms and rates. You have already asked us for this list.

- Sign the Buyer Representation Agreement and return it to us. We will send this to you via email once we’ve decided to work together.

- Review the estimated closing costs you received from your Lender.

- Interview and select a Home Inspector. We will send you our home inspection and referral list via email. The home Inspector generally costs $350-$1,200 depending on whether you’re buying a condo or single-family home and how large and how many additional features you have selected. My Home Inspector will be:

- Name: __________________________________

- Email:___________________________________

- Phone: __________________________________

- Change privacy settings on Facebook and LinkedIn to the highest security settings possible, while still allowing people to Friend you. Do not post anything about your home search as it can be used against us during negotiations.

- Send a copy of your preapproval letter to us as well as the contact info for your mortgage Lender/Broker.

- Keep us updated on your mortgage process.

- Do not buy anything expensive or open new credit cards. Pay all bills on time. Be very careful with your finances from now until we close.

- Decide whether you want a home warranty and if this is something you want to purchase or would like us to try and negotiate during the negotiation process.

- Ask Andi and download her mobile app for your smartphone. It is the real estate industry's national search portal, featuring accurate, real-time information that Brokers use. Then when you’re out, and you see a For Sale sign, you can pull up the app and get fast answers.

- ·Review a practice Purchase & Sales Agreement at the beginning of your home search, so you are comfortable with understanding the Purchase & Sales Agreement when the time comes to put in an offer. Ask us to send these to you when you’re ready to review them and we can go over them together.

Questions? Contact us at andi@andidyer(dot)com or 360-734-6479.