7 Cleaning Tips for Keeping Your Home Spotless When Selling It

When your house is on the market , keeping it picture-perfect can be a wee bit stressful. But it is possible to keep your home show-ready while life goes on.

Here are seven cleaning tips on how to do it.

#1 Invest in Clear Bins

The less stuff you have out, the less you have to keep tidy. Keep as few (depersonalized, aesthetically pleasing) items in your home as possible, from décor to clothes. Thin out closets, garage, bookcases, TV armoires — any place clutter collects .

Of course, that means your storage spaces are going to get a workout. “This is a great time to buy those big, plastic tubs because they’re cheap, and they make everything look uniform,” says Dale Boutiette, a real estate agent with the Dale + Alla Team in San Francisco.

Keep your tidy storage tubs somewhere out-of-the-way but accessible. You’ll be a more effective clutter-culler if you know you can get to your stuff when you need it.

#2 Clean As You Go

When your home is on the market, cleaning isn’t a thing you do; it’s the way you live.

“Assume you’ll have a showing every day,” says Maura Black, sales vice president at Sibcy Cline REALTORS® in Cincinnati. “So clean as you go.”

Every time you finish an activity or leave a room, make it your goal to look like you were never there.

Deposit dirty dishes in the dishwasher or wash and stow them after each meal. Make the bed when you get up. Fold laundry straight from the dryer and put it away immediately. You get the idea.

“That may take a few extra minutes up front, but it relieves a ton of stress at showing time,” says Black.

Every time you finish an activity or leave a room, make it your goal to look like you were never there.

#3 Use Only One Bathroom

Few areas of your home need to be as spotless for buyers as the bathroom — but also, you know, stuff happens in there. Every day. Sigh.

Consider using only one bathroom while your home is on the market. The fewer toilets to scrub in a hurry, the better.

And keep that one bathroom as near-perfect as possible while in use:

- Squeegee the tub or shower after every use.

- Wipe the sink and counter after every use, too: brushing your teeth, applying makeup, washing hands, spraying hairspray, etc.

- Clean the toilet and wipe down the floor each day.

#4 Tackle Odors Every Day

Odors are an instant turnoff for buyers, and new odors appear every darn day. Start off on the right foot by paying a pro or doing your own super-deep cleaning with a focus on olfactory messes : grease build-up, stinky drains, musty basements, etc.

Then, do a daily disinfectant sweep of your home’s stinkiest spots:

- Wash your trash cans every time you take out a bag.

- Vacuum under furniture.

- Wipe down baseboards and window sills (where dust — thus, smells — get trapped).

- Do a careful cleaning of your stove and surrounding cupboards after you cook so tonight’s dinner doesn’t become tomorrow’s turnoff for buyers.

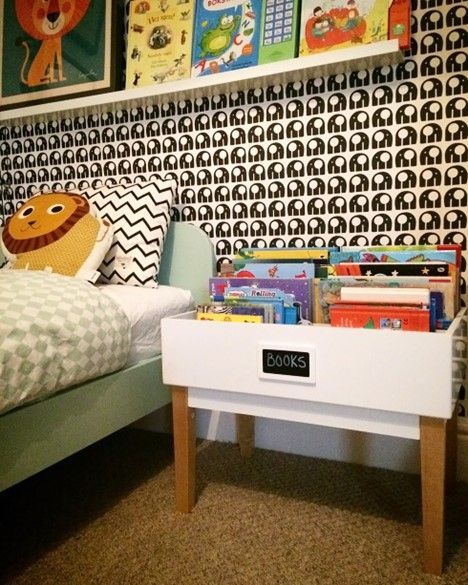

#5 Rotate Kids’ Toys and Books

If you have kids, you know containing the daily hurricane of toys is a challenge on a normal day.

When your home’s on the market, it’s time to get extra strategic. First step? Banish toys from all but one room. Whether it’s a playroom or bedroom, keep the toys behind one door at all times.

Then deal with quantity.

Divide the whole toy collection into groups and designate tubs for each. The kids can play with one group at a time, and the rest go into a closet. If only so many toys are accessible, only so many toys can be everywhere when a buyer is on the way.

Finally, keep your active group of toys in some sort of nice, accessible storage system, like cute bins or baskets.

“My favorites are open baskets,” says Becky Rapinchuk, author of Simply Clean: The Proven Method for Keeping Your Home Organized, Clean, and Beautiful in Just 10 Minutes a Day and cleaning pro at Cleanmama.net. “They’re attractive, and they let kids easily see and access toys, while looking great for showings.”

#6 Send Pets on Vacation

Oh, how we love our pets. And oh, how they do not love showing season. You’re stressed because their fur is everywhere, and they’re stressed because you’re stressed, and stress makes them … shed more.

If you can send them to a friend or relative while your house is on the market, it can lower everyone’s blood pressure and keep your house as hair- and dander-free as possible.

If that’s not an option, here are some alternative strategies:

- If you have more than one pet and enough household members, appoint each member their own pet and assign daily cleaning tasks: brush pets’ fur, clean their bowls and eating areas, vacuum their favorite napping spot, etc.

- Take them away with you, or confine them to a crate or separate quarters when buyers come.

- If you have an old or sick pet you can’t leave alone or take elsewhere, ask your agent to restrict showing times to when you can be there. This isn’t optimal since most buyers prefer owners aren’t present during the showing, but people are generally pretty understanding about special considerations like pets. Just keep your pet (and yourself) away from potential buyers during the showing.

#7 Drive Away With the Laundry

No matter how showing-ready your home is at all times, there’s one thing that’s often tough to time perfectly: the laundry.

For many busy families, the massive laundry operation is always some stage of unfinished, and you just can’t run the washer and dryer any faster.

While you can do your best to stay on top of it, if you get a text that a buyer is on the way and you have piles of dirties awaiting their turn, Rapinchuk has a tip: Toss ’em in a basket, stow the basket in the car, and drive away. You may not be Martha-perfect, but buyers don’t need to know that.

article source: www.houselogic.com/organize-maintain/cleaning-decluttering/cleaning-tips-decluttering-when-selling-house/